Embarking on the Investment Journey: Building Wealth with a Fresh $10,000 Portfolio

The start of an investing journey with $10,000.

Welcome, fellow investors, to a thrilling adventure in the world of finance! In this inaugural blog post, we're setting sail on a journey that begins with a clean slate—a fresh $10,000 portfolio—and we'll navigate the ever-changing seas of the financial market together.

The decision to kick start this portfolio is not only a personal commitment but a shared exploration into the realm of possibilities that the financial markets offer. Whether your aspirations involve achieving financial freedom, funding future endeavors, or simply growing your wealth, our journey begins with a symbolic $10,000.

The first stock that I looked into was Shopify, also known as $SHOP by its ticker symbol. There are a total of five main reasons why I decided on $SHOP here as opposed to many of the top blue chip stocks in the current market.

- Current Stock Price Discount: The decision to acquire call options on $SHOP was spurred by the attractive discounted price of the stock. Markets are known to be cyclical, and seizing opportunities during a temporary dip can be a game-changer. Shopify, a company synonymous with e-commerce innovation, faced a short-term decline, offering a favorable entry point for those with a keen eye for value.

- Potential Rate Cuts in 2024: The economic landscape is ever-evolving, and as we navigate the twists and turns, it's crucial to stay attuned to macroeconomic factors. The anticipation of potential rate cuts in 2024 adds an interesting dimension to growth companies like Shopify. Historically, lower interest rates have been associated with a conducive environment for growth stocks, providing them with the financial flexibility to expand and innovate.

- Year-over-Year 4th Quarter Results: Shopify has a historical track record of benefiting significantly from the 4th quarter, a period marked by increased consumer spending during the holiday season. By strategically aligning our investment with this seasonal uptick, we position ourselves to potentially capitalize on blowout earnings. The expectation of increasing year-over-year 4th quarter results adds another layer of optimism to this investment thesis.

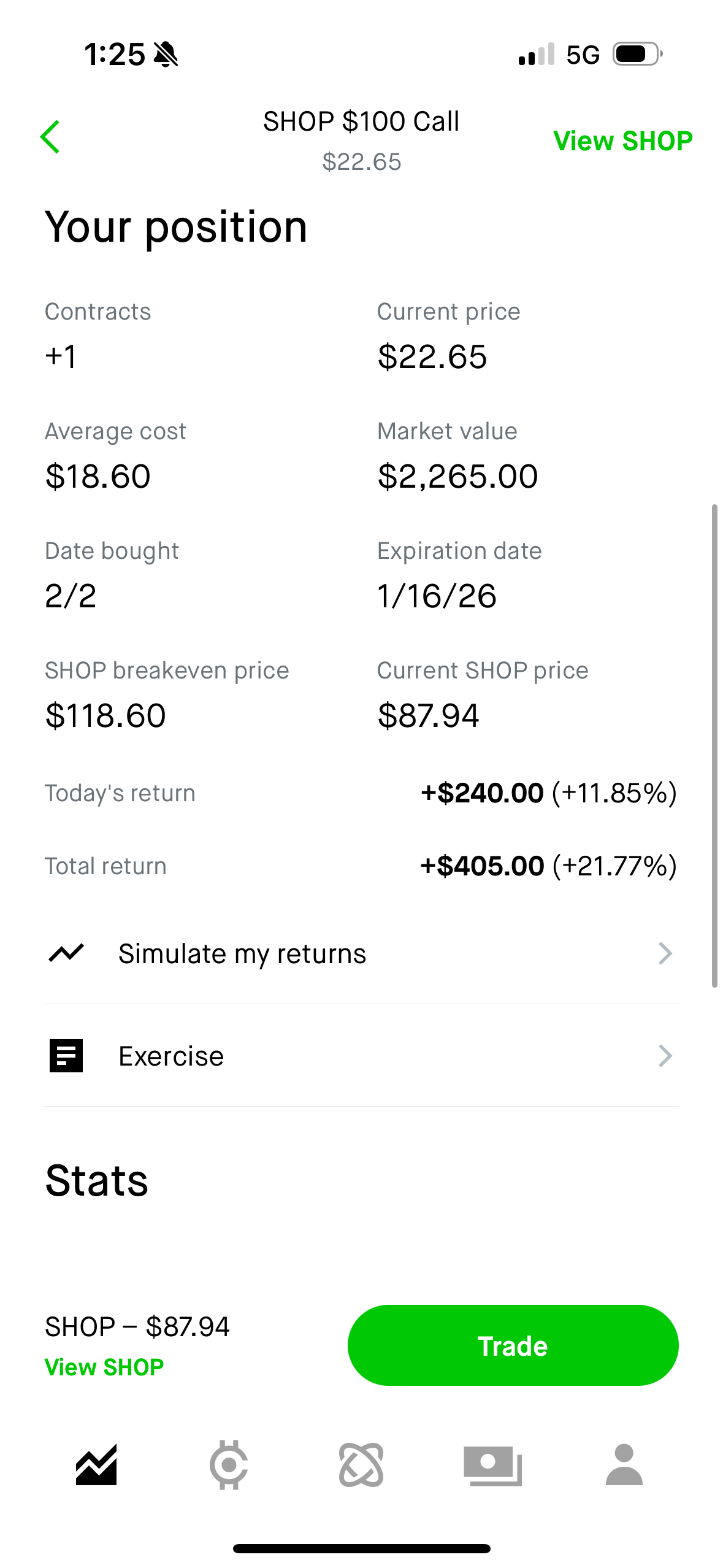

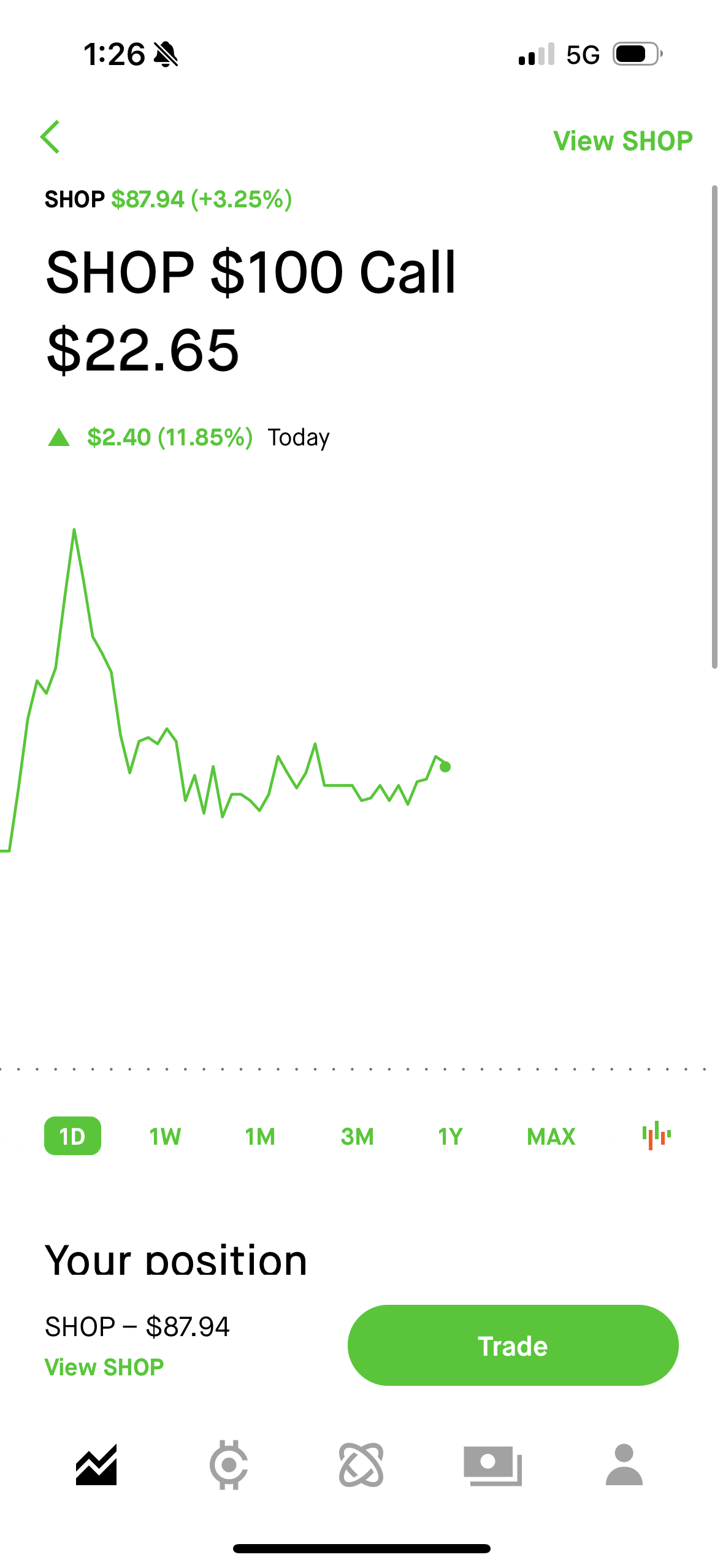

- Strategic Options Play: The $100 strike calls provide a leveraged opportunity to benefit from the upside potential of $SHOP. By opting for a call option with an expiration date in January 2026, I've allowed ample time for the investment thesis to unfold. This strategic move aligns with the belief that Shopify's intrinsic value will be recognized and reflected in the stock price over the coming year.

- Risk Management and Awareness: It's essential to acknowledge the inherent risks associated with options trading. While calls provide an opportunity for amplified gains, they come with the risk of expiration without value if the stock doesn't reach the strike price. As responsible investors, understanding and managing risks is a cornerstone of our approach.

$SHOP Contract - $100C 1/16/26 @ $18.60

Disclaimer: This post is not financial advice, and investment decisions should be made based on thorough research and individual risk tolerance. Options trading involves significant risks and may not be suitable for all investors. Always consult with a financial advisor before making investment decisions.