Doubling Down on Innovation: My $NVDA LEAP in the AI Surge Era

Investing in NVIDIA reflects a strategic move towards the future, leveraging its unparalleled growth in data center revenues and AI.

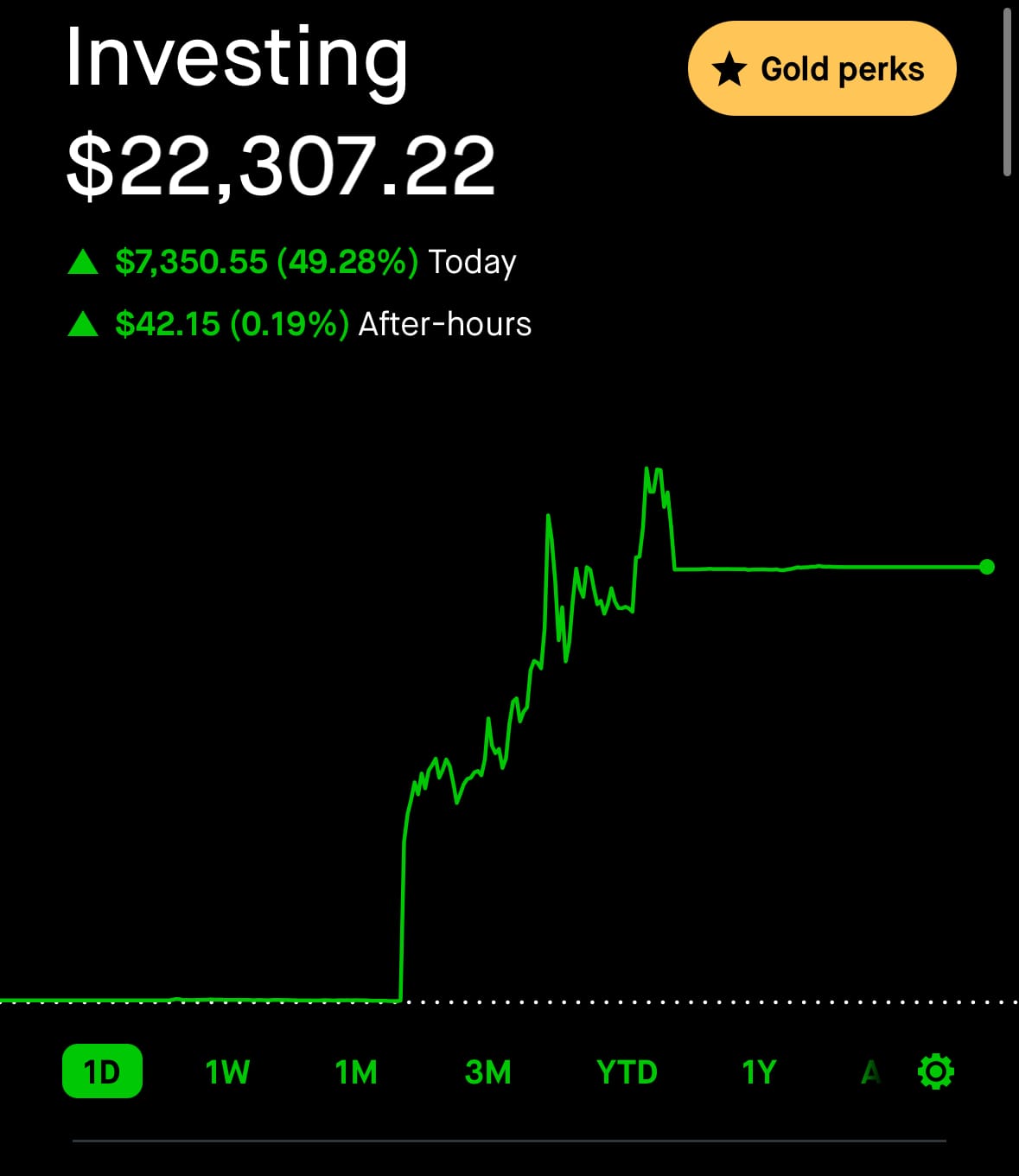

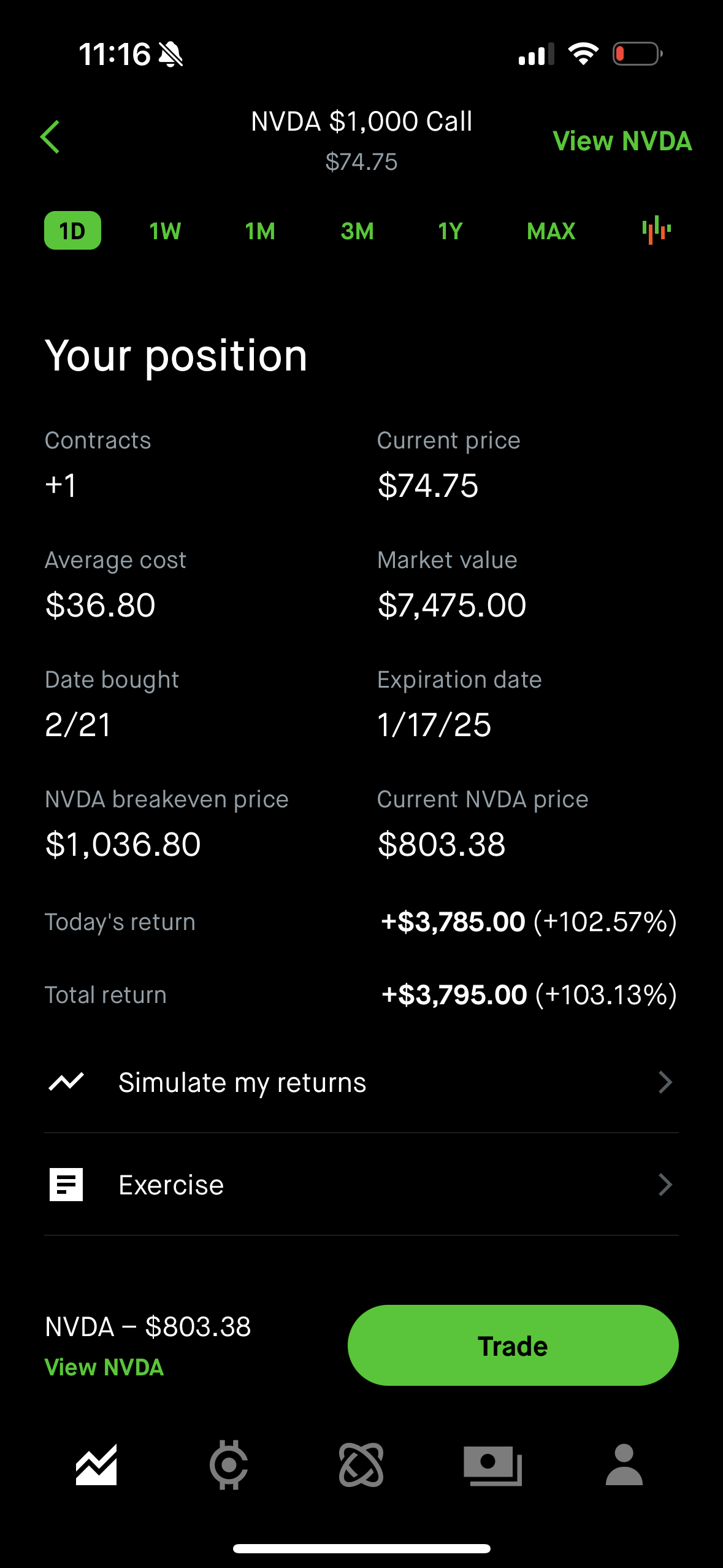

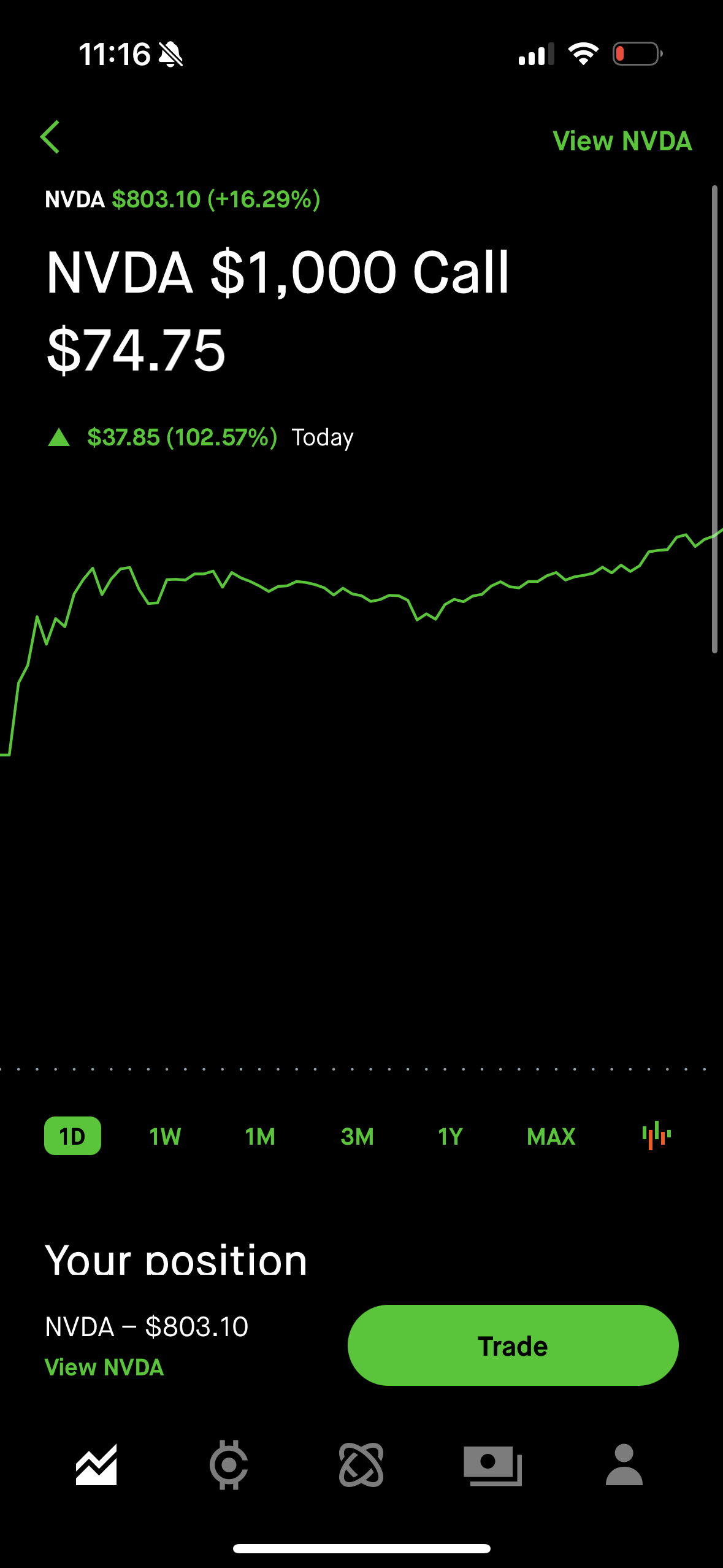

As we bid farewell to our $SMCI weekly option—a key player in our portfolio's impressive growth—it's time to unveil our next strategy in the investment game: the NVDA $1000C 1/17/2025 LEAP option. This decision is not a mere pivot but a calculated choice, driven by the surge in the AI sector and NVDA's pivotal role within it.

Why NVIDIA at All-Time Highs?

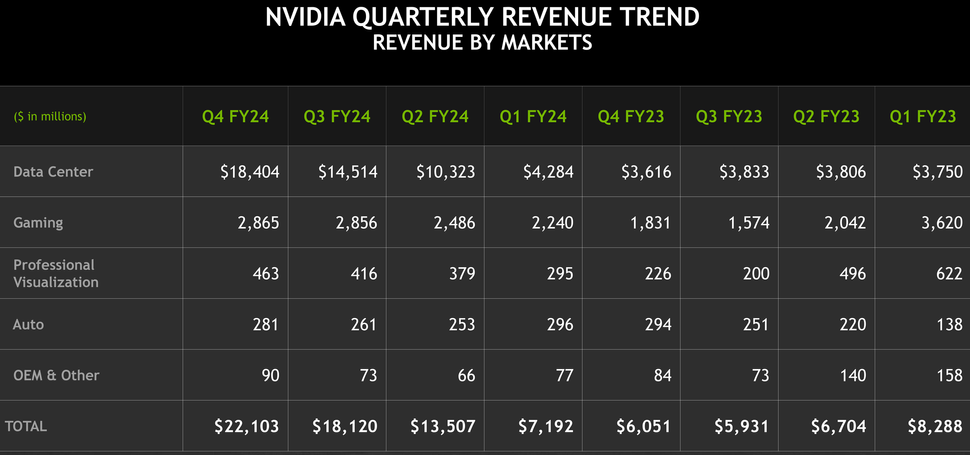

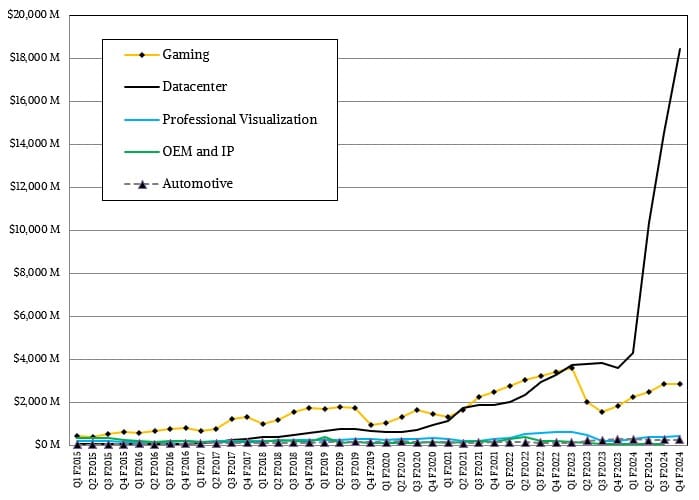

NVIDIA's data center segment has seen an exponential growth trajectory over the recent fiscal years, demonstrating the company's successful penetration and expansion within the cloud computing and artificial intelligence markets. Here's a closer look at the numbers that highlight this growth:

For the fiscal year 2024, NVIDIA reported a record full-year revenue of $60.9 billion, marking a 126% increase, with the data center revenue reaching $18.4 billion in the fourth quarter alone which further cements NVIDIA's status as a leading force in the tech industry.

Why This Matters for Investors

The data center segment's explosive growth signifies NVIDIA's successful capture of market share in the rapidly expanding AI and cloud computing markets, areas with long-term growth prospects. Moreover, the sustained high growth rate of NVIDIA's data center business indicates the company's potential for continued revenue expansion and profitability. Opting for a LEAP option on NVIDIA allows us to capitalize on this growth with a relatively low upfront investment as opposed to purchasing shares with our smaller portfolio.