Post-Earnings Update on $NVDA Call Options

Discover the latest update on our $NVDA call option following NVIDIA's May 22nd earnings report. Learn about the impact of the 10-for-1 stock split, current contract values, and the future outlook driven by NVIDIA's strong performance in AI and cloud computing.

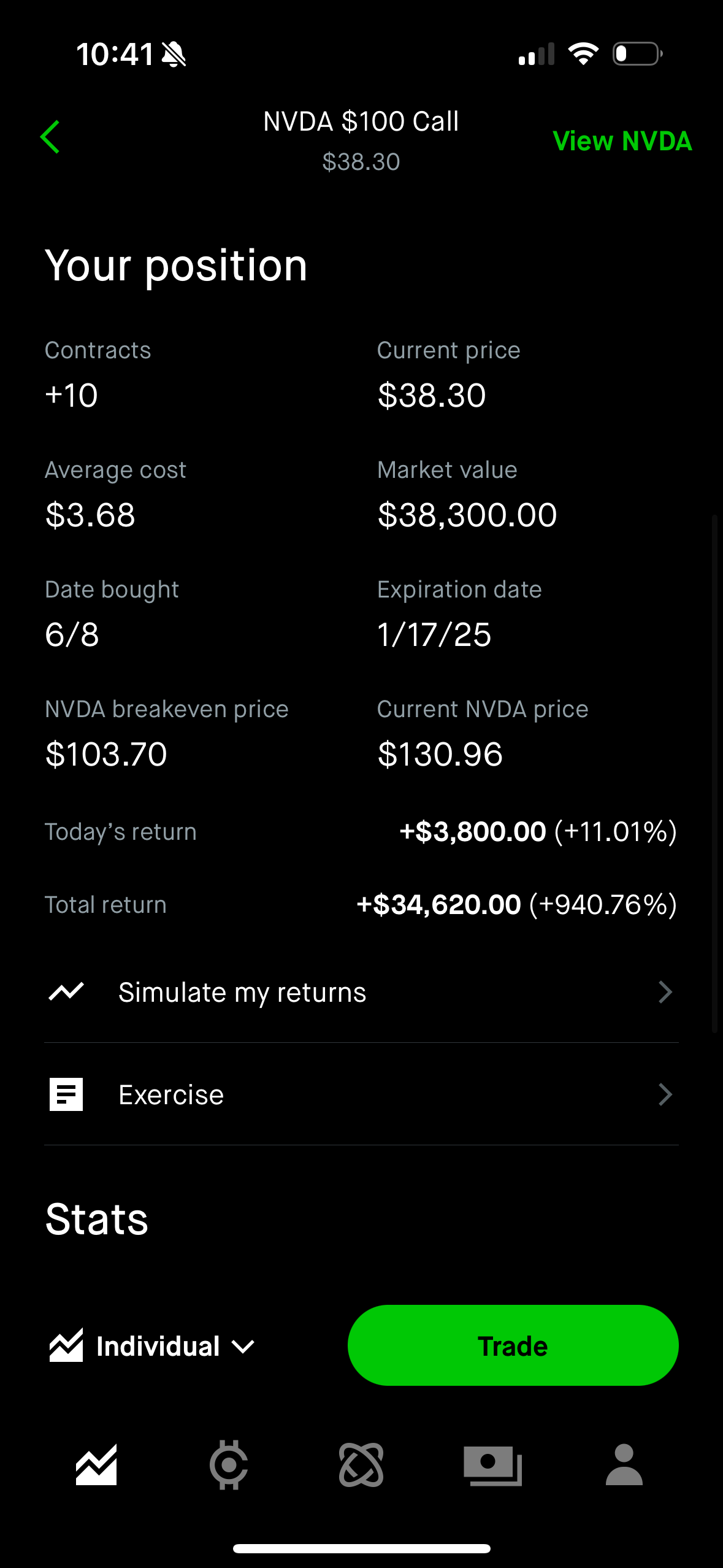

In our previous post, we discussed the purchase of a $NVDA LEAP call option. Following the latest earnings report on May 22nd, it's time to provide an update on the current status of this position. NVIDIA has once again demonstrated its strength in th AI and data center markets. We've held through two earnings reports now with great results.

Initial Purchase and Position

To recap, we initially bought a $NVDA LEAP call option at a cost of $36.80. After NVIDIA's recent 10-1 stock split following their earnings report, it is now 10 contracts. As of now, each contract is valued at $38.30. This helps our position greatly because it makes the pricing of the stock post split be cheaper which allows more buyers to step in.

Market Outlook and Strategy

The company is well positioned to capitalize on several growing markets, including artificial intelligence, machine learning, and cloud computing. Since NVIDIA is the market leader in these sectors because they pivoted at a crucial time when AI and machine learning was still in its early stages they were able to capture the majority of the market share for their data centers which has been driving most of the growth.

Our strategy here is to hold the position while closely monitoring the market for any further developments. If we see a slowdown in AI, from other companies spending or in other semiconductor companies then we may want to trim the position as we see fit to lower our exposure as well as realize the gains we've made thus far. It is very important to make sure you realize the gains on your positions when you feel appropriate as with options especially it can turn on you very quickly.